UMass Global offers a wide variety of degree programs for adult learners. Explore your financial options and find a degree that fits you.

Financing your education is one of the top concerns for new students going back to college. Navigating federal loans, grants, and other funding options can be daunting, but it doesn't have to be. Some schools like UMass Global, offer support services for understanding the steps you need to take to pay for your degree, but it's still important for you to do your research.

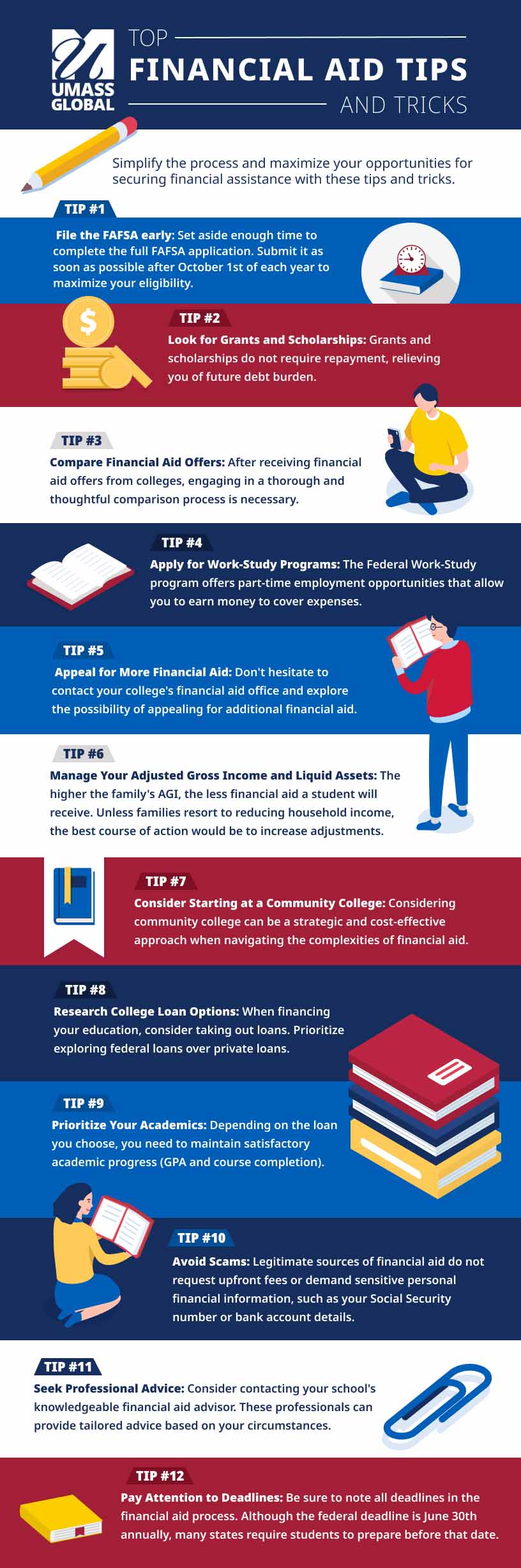

Here are our top 12 financial aid tips and tricks to help you navigate the process of paying for college:

- Tip #1: File the FAFSA Early

- Tip #2: Look for Grants and Scholarships

- Tip #3: Compare Financial Aid Offers

- Tip #4: Apply for Work-Study Programs

- Tip #5: Appeal for More Financial Aid

- Tip #6: Manage Your Adjusted Gross Income and Liquid Assets

- Tip #7: Consider Community College

- Tip #8: Research College Loan Options: Federal Loans vs Private Loans Tip #9: Prioritize Your Academics

- Tip #10: Avoid Scams

- Tip #11: Seek Professional Advice

- Tip #12: Pay Attention to Deadlines

Tip #1: File the FAFSA Early

The Free Application for Federal Student Aid (FAFSA) is crucial for most financial aid programs. Submit it as soon as possible after October 1st each year to maximize your eligibility for aid.

Trick: Practice Filling Out the FAFSA

Practicing filling out the FAFSA is a great way to prepare for the nuances of the application. Studentaid.gov provides a yearly FAFSA on the Web Worksheet to help students collect all of the necessary information prior to submitting the real thing. This tool provides a preview of questions tasked on the actual application. Leave no entry on the form blank. If the answer is not applicable or a dollar amount cannot be attributed, fill the section with a 0. This tip is generally for those filling out the traditional paper version of the form, since the online version will not allow you to proceed without entering a value (hint: the online version is faster and easier).

Be sure to set aside enough time to complete the full FAFSA application, which has around 130 questions relating to the student and their family's financial status including income, household size, number of siblings in college, and more. Most questions are straightforward, such as social security number and citizenship, while others may require more time to collect the necessary information and documentation.

Tip #2: Look for Grants and Scholarships

Grants and scholarships stand out as exceptional sources of funding because they do not require repayment, relieving you of the burden of future debt. To optimize your chances of securing financial assistance, it's essential to cast a wide net in your search. Start by exploring federal grants, such as the Pell Grant, which is often awarded based on financial need. Additionally, check grants.gov for state-specific grant programs that may be available to residents of your state.

Furthermore, many colleges and universities offer their own institutional grants and scholarships, which can be a valuable source of financial support. UMass Global partners with a variety of businesses and local organizations to offer scholarships for students upon acceptance into your degree program. You may also want to look for scholarships from private organizations and community groups. Many scholarships are available for different qualifications and interests. Use the U.S. Department of Labor’s free scholarship search tool to find one most applicable to you.

Tip #3: Compare Financial Aid Offers

After receiving financial aid offers from colleges, it is crucial to engage in a thorough and thoughtful comparison process. Prioritize accepting non-repayable aid, such as grants and scholarships, as they do not accumulate interest or require repayment. If you received loan offers, carefully review the terms, interest rates, and repayment options. You’ll want to understand the financial impact these loans may have on you long-term throughout your post- graduate years. Lastly, verify if your aid options can be combined, particularly if you need to utilize loans in addition to your grants.

Tip #4: Apply for Work-Study Programs

The Federal Work-Study program stands as a valuable resource designed to empower students in their pursuit of higher education by offering part-time employment opportunities that allow them to earn money to cover their educational expenses. It represents a dynamic partnership between eligible students, educational institutions, and various employers, fostering a unique learning experience while helping to alleviate the financial burden of college.

These part-time jobs can encompass a wide range of roles, both on and off-campus, such as working in administrative offices, libraries, community service organizations, or research projects related to your field of study. Additionally, these positions often offer flexible schedules to accommodate your academic commitments, ensuring that your work does not compromise your primary focus on your education. For those considering the benefits of Federal Work-Study, it's crucial to explore whether you qualify for this program. Eligibility criteria often consider your financial need, as determined by the Free Application for Federal Student Aid (FAFSA).

Tip #5: Appeal for More Financial Aid

Life is unpredictable, and sometimes unexpected financial challenges can arise during your college journey, such as job loss or unexpected medical expenses. It's essential to know that you're not alone in facing these challenges, and there are options available to help you navigate them. If you find yourself in a situation where your financial circumstances have changed, don't hesitate to reach out to your college's financial aid office and explore the possibility of appealing for additional financial aid.

The timing of your appeal can be crucial. Reach out as soon as you become aware of a significant change in your financial situation. Some colleges may have specific deadlines for appeals, so inquire about the process and deadlines to ensure you don't miss any opportunities for assistance.

Trick: Use a Supplementary Letter to Explain Extenuating Circumstances

Although the FAFSA is designed to be as inclusive of details as possible, it does not provide a section to allow students to explain special circumstances such as recent unemployment or high medical bills. If there are extenuating circumstances in your personal financial situation, send a supplementary letter explaining the issues. According to an article published by TIME, a senior adviser at College Confidential says, "The FAFSA is a critical document, but it isn’t the only document. Many colleges will respond in a holistic way when extenuating circumstances are spelled out to them."

It is important to provide documentation, preferably from a third party, to confirm your claims. In the example of high medical bills, items such as invoices or credit statements can help build a case for

Tip #6: Manage Your Adjusted Gross Income and Liquid Assets

Adjusted Gross Income (AGI) equals income less adjustments. This simple formula can determine the amount of financial aid you are eligible for. The higher the family's AGI, the less financial aid a student will receive. Given the calculation, unless families result to reducing household income, which of course is not a popular option, the best course of action would be to increase adjustments. A good accountant or tax professional can help you through this process.

AGI is not the only formula in the financial aid process. The federal government has entire algorithms that contribute to evaluating need-based loans, grants, and other forms of aid. The FAFSA's formula for determining Expected Family Contribution (EFC) relies heavily on the amount of liquid assets in a family including bank accounts. Although it is of course not recommended to give away cash or money in savings and checking accounts, shifting assets, or paying off large debt balances such as a mortgage may help limit liquid assets. This strategy is particularly helpful for big savers and big spenders. College Board provides a financial calculator to help families estimate their EFC.

Tip #7: Consider Starting at a Community College

Considering community college can be a strategic and cost-effective approach when navigating the complexities of financial aid. Community colleges often provide quality education at a fraction of the cost compared to four-year institutions. Financial aid is also offered for community college, further reducing the out-of-pocket expenses of already more affordable semester fees.

Additionally, community colleges offer flexible scheduling, making it easier for students to work part-time jobs to support their education. Combined with work-study opportunities, community college can be beneficial for those who need more time to save prior to transferring while still completing general education courses.

After completing your GE courses, you will be able to transfer your credits and complete your bachelor’s degree. Four-year institutions offer more advanced courses that align with your major and are required to graduate. At UMass Global we accept transfer credits through our block transfer. If you are in California, we also participate in “Degree With a Guarantee” and in Massachusetts we participate in “MassTransfer Gen Ed Foundation.”

Tip #8: Research College Loan Options: Federal Loans vs Private Loans

When it comes to financing your education and considering the possibility of taking out loans, it's essential to make an informed decision that aligns with your long-term financial well-being. One crucial piece of advice is to prioritize exploring federal loans over private loans.

Federal loans come with several advantages that can significantly ease the burden of student debt. First and foremost, federal loans offer more favorable interest rates compared to their private counterparts. These lower interest rates can translate into substantial savings over the life of your loan, making your repayment journey more manageable.

Moreover, federal loans provide a safety net of flexible repayment options that cater to your unique financial circumstances. Federal loan repayment plans are designed to be adaptable, allowing you to choose from various options, such as income-driven repayment plans, which calculate your monthly payments based on your income and family size. This flexibility ensures that you can adjust your repayment strategy as your financial situation changes over time.

Federal loans also offer borrower protections that private loans generally do not provide. These protections include options for loan deferment or forbearance during times of financial hardship, as well as the potential for loan forgiveness programs, particularly for individuals pursuing careers in public service or nonprofit organizations.

Lastly, federal loans do not typically require a co-signer or a credit check, making them accessible to a broad range of students, including those with limited credit history or no credit at all. In contrast, private loans often come with variable interest rates and less flexible repayment terms. They may require a creditworthy co-signer, potentially limiting your options if you or your co-signer do not meet the necessary credit criteria.

Tip #9: Prioritize Your Academics

Depending on the loan you choose, you will need to maintain satisfactory academic progress (GPA and course completion) as required by your college or university. This is particularly critical for students receiving scholarships and/or grants.

Your GPA serves as a reflection of your academic performance. Maintaining a solid GPA is not only beneficial for your overall educational experience, but is often a prerequisite for continuing to receive financial aid.

Course completion emphasizes not only attending classes but also actively engaging in your coursework, meeting deadlines, and achieving passing grades. Consistently failing courses or dropping them can jeopardize your financial aid eligibility.

Tip #10: Avoid Scams

Be cautious of scholarship and financial aid scams. Always remember that legitimate sources of financial aid do not request upfront fees or demand sensitive personal financial information, such as your Social Security number or bank account details.

Additionally, thoroughly research and verify the credibility of any organization or website offering scholarships to ensure they have a reputable track record. By staying informed and cautious, you can protect yourself from fraud and focus your efforts on securing genuine financial support for your education.

Tip #11: Seek Professional Advice

If navigating the intricate landscape of financial aid leaves you with uncertainties or questions, don't hesitate to seek guidance to ensure you make informed decisions. Consider reaching out to a knowledgeable financial aid advisor at your school. These professionals are well-versed in all the financial aid programs available and can provide tailored advice based on your circumstances.

Alternatively, consulting a certified financial planner can be a valuable step, especially if you are looking for comprehensive financial advice beyond just financial aid. They can assist you in creating a financial strategy that aligns with your educational goals and long-term financial well- being. As a working adult, they can also help you adjust your existing budget to help cover educational expenses. By leveraging the expertise of these professionals, you can gain clarity and confidence in your financial decisions, helping you make the most of your educational investment.

Tip #12: Pay Attention to Deadlines

As with class assignments, paying attention to deadlines is one of the most crucial details of the financial aid process. Although the federal deadline is June 30th annually, many states require students to prepare well ahead of that date, setting shorter timelines for filing out the FAFSA. Schools may have additional variances in preferred filing timelines, so students are encouraged to check all sources. For many nontraditional students that attend online classes, living in one state while attending a school in another, the most important fact to remember is state of residence determines when financial aid applications are due.

For example, UMass Global offers fully online programs and students live in many states across the country. For California residents the initial filing date is April 2nd, and it’s UMass Global’s preference. However, for students residing in Vermont or Washington early submission determines availability. These two states are part of a set of seven regions that award aid on a first-come, first-serve basis. Others following this rule include Illinois, Kentucky, North Carolina, South Carolina, and Tennessee. In these cases, filing early is the primary factor for determining financial aid qualifications. So remember: Check school, state of residence, and federal deadlines during the financial aid planning process.

Bottom Line: Plan Ahead & Use Available Resources

Remember that your school, financial advisors, and FAFSA staff can be helpful resources when applying for financial aid. Many schools, like UMass Global, follow the One Stop student services model. Find out what services your school provides for assistance. Share these quick financial aid tips and tricks with your friends and family and get started today:

- Find out your school, state of residence, and federal deadlines before applying.

- Adjust and spend where needed to use federal formulas to your advantage.

- Plan ahead and practice before filling out the official form.

- Explain any circumstances that may not be included as part of the FAFSA.

Ready to take the next step in becoming an adult learner? Speak with an enrollment coach at (800) 746-0082 today.